Biden Goes After American Energy Producers With Punitive Tax Proposal

President Biden is planning to harm the domestic oil and gas industry and make them less globally competitive despite asking them to produce more energy. Biden’s budget proposal for fiscal year 2024 is for the astounding amount of $6.9 trillion and includes withdrawing tax deductions from oil and gas businesses that other manufacturing entities receive and would harm the small mom-and-pop companies whose production is critical for meeting demand. Biden’s proposal claims that eliminating “special” tax treatment for oil and gas company investments, as well as other fossil fuel tax preferences, would save the government nearly $31 billion over 10 years. Biden’s budget demonstrates the contradictions in his energy policy because while Biden calls for increasing American oil and natural gas to meet consumer demands, he fails to issue leases, closes areas to exploration and discourages future investment by proposing new discriminatory taxes in his budget. Then to top it off, he proposes removing tax deductions from the oil and gas industry. Removing these routine business deductions will lower domestic output while further raising already high oil and gasoline prices.

Oil and Gas Tax Deductions

The White House in one of its budget fact sheets states, “The President is committed to ending tens of billions of dollars of federal tax subsidies for oil and gas companies. Even as they benefit from billions of dollars in special tax breaks, oil companies have failed to invest in production.” What Biden’s budget calls “subsidies” for the oil and gas industry are tax deductions that are mainly targeted to small independent oil and natural gas producers, rather than the major integrated oil companies usually described as “big oil.” Independent oil and gas producers develop 91 percent of the wells in the United States – producing 83 percent of America’s oil and 90 percent of America’s natural gas. There are about 9,000 independent oil and natural gas producers in the United States, operating in 33 states and offshore who employ an average of 12 workers. Independents can be small family companies or publicly traded companies but they are vital parts of their local and regional economies, spinning off wealth and job creation and contributing to their communities.

The two tax deductions that primarily affect small independent producers are the percentage depletion allowance and expensing of intangible drilling costs. As the oil and gas in a well is depleted, independent producers are allowed a percentage depletion allowance to be deducted from their taxes. While the percentage depletion allowance sounds complicated, it is similar to the treatment given to other businesses for the depreciation of an asset. The tax code essentially treats the value of a well as it does the value of a newly constructed factory, a new vehicle or a new tractor, allowing a percentage of the value to be depreciated each year. This allowance was first instituted in 1926 to compensate for the decreasing value of the resource, and was eliminated for major oil companies in 1975. This tax deduction is estimated to save independent oil and gas producers about $0.5 billion in the fiscal year 2022.

Independent producers are also allowed to count certain costs associated with the drilling and development of wells as business expenses. The law allows the small producers to expense the full value of these costs, known as intangible drilling costs, every year to encourage them to explore for new oil. The major companies get a portion of this deduction—they can expense a third of intangible drilling costs, but they must spread the deductions across a five-year period. This tax treatment is also similar to that of other businesses for such investments as research and development. This tax deduction is estimated to save oil and gas producers about $0.4 billion in the fiscal year 2022.

Another tax deduction is the Domestic Manufacturing tax deduction, which allows all industries and businesses (not just oil companies) to deduct a certain percentage of their profits—for the oil and gas industry, it is 6 percent, for all other industries (software developers, video game developers, the motion picture industry, and green energy producers, among others), it is 9 percent.

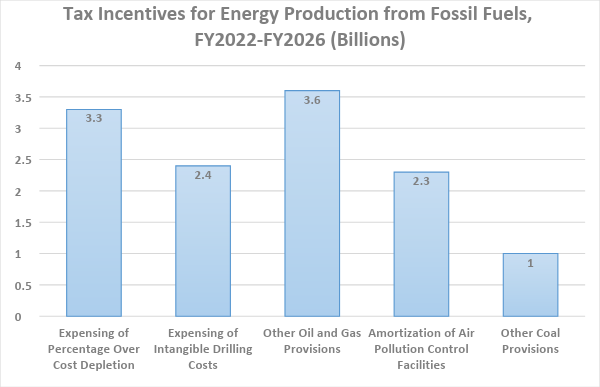

According to Reuters, the Joint Committee on Taxation, a nonpartisan panel of Congress, has estimated that eliminating intangible drilling costs could generate $13 billion for the government over 10 years and the percentage depletion tax break, which allows independent producers to recover development costs of declining oil gas and coal reserves, could generate about $12.9 billion in revenue over 10 years. However, doubling the tax deductions over a 5 year period shown in the above graph for those provisions does not produce the numbers cited by Reuters.

Some of What Biden Wants Instead

Biden’s budget proposal includes $375 million for grants to assist weatherization of homes and $800 million for efficiency upgrades through LIHEAP– the Department of Health and Human Services’ Low Income Home Energy Assistance Program. Another $300 million would target energy efficiency and climate resilience in public housing, and more than $5 billion would go to fund climate and energy-efficient technology research at various agencies and bureaus, including the Interior Department, the Commerce Department, NASA and the National Science Foundation. Another $35 million would be put toward creating a new laboratory at a historically Black college or university through the Department of Energy’s Office of Energy Efficiency and Renewable Energy.

The Biden budget also calls for increased funds for federal agencies’ activities in offshore wind. It requests $64.5 million for the renewable energy program of the Department of the Interior’s Bureau of Ocean Energy Management (BOEM) – $21.6 million more than for FY 2023. This includes a $12 million increase to support permitting associated with moving the current offshore wind leasing path forward, despite calls from environmentalists and local officials to halt the program because of an increase in dead whales. The budget proposes $92.8 million for BOEM’s Environmental Programs, an increase of $10.4 million, which includes funding for environmental review associated with renewable energy projects. The budget earmarks $60 million to expand offshore wind permitting activities at the National Oceanic and Atmospheric Administration (NOAA), an agency under the Department of Commerce which last year joined BOEM in Biden’s goal to reach 30 gigawatts of offshore wind capacity by 2030.

Conclusion

Biden is on the oil and gas warpath again. He wants the oil and gas companies to increase production while taking their tax deductions and future opportunities away. Biden began his anti-oil and gas policies on inauguration day and he has continued them non-stop since then with the latest being the removal of 16 million acres in Alaska from oil and gas exploration. Instead, he wants to electrify everything and have the United States run solely on renewable energy. Today, after years of government incentives and mandates, renewable energy represents only 13 percent of the U.S. energy system while fossil fuels represent 79 percent. When will the U.S. government realize where it should put its money for energy development that is reliable and affordable?

*This article was adapted from content originally published by the Institute for Energy Research.