With Electricity Prices On The Rise Biden Intensifies War On Coal

It is anticipated that President Biden’s Environmental Protection Agency (EPA) will soon release new and expanded regulations that will result in coal’s demise. EPA is expected to release six new rules covering everything from carbon to coal ash, which are expected to trigger new coal plant retirements as the cost of keeping coal plants operational with the new regulations increases. Most of the existing coal plants have already paid off their capital costs, but these regulations could make them pay for costly pollution control equipment, even though the U.S. has a remarkable record of clean air and clean-burning energy. That increase along with less operating time to recover costs as more wind and solar plants come online driven by subsidies and mandates could make more coal plants uneconomic.

Biden sees that as a must to meet his pledge to cut 80 percent of the generating sector’s emissions by 2030 compared with 2005 levels and reach net zero five years later. Those goals are part of Biden’s broader commitment to address climate change — which he called an “existential threat” in his State of the Union address. They also fulfill his recent promise to shut down coal plants in the United States. The United Nations called on wealthy nations to do away with unabated coal use this decade to keep the Paris Agreement’s temperature goals in line and give less-wealthy countries time to act.

EPA is expected to advance six rules this spring and summer that could levy new costs on coal-fired units. These include two actions teeing up tougher rules for mercury and air toxics, a final rule for pollution that crosses state lines, a final rule for coal plant waste that gets into groundwater and a proposal for legacy combustion residuals. The two power plant carbon rules for new and existing units are set to be proposed in April.

In 2007, coal supplied about half of all generation on the U.S. power grid. In 2022, that figure dropped to 20 percent, behind natural gas and renewables when combining the generation shares from hydroelectricity, wind, solar, geothermal and biomass. This year nuclear power is also expected to overtake coal, dropping coal’s share to fourth place. Most projections, however, expect coal to occupy a small share of the market through 2030 and beyond despite U.S. climate envoy John Kerry’s declaration at climate talks in Glasgow in 2021 that “by 2030 in the United States, we won’t have coal.” Analysts expect that challenges associated with bringing new power sources online will help keep some coal plants operating, despite cost and climate considerations.

Substantial Federal incentives in the Inflation Reduction Act for wind, solar, batteries and new-builds are expected to benefit renewable energy over coal and other sources. Rhodium Group estimates that the law could cause between 30 gigawatts and 60 gigawatts of coal plants to be retired on top of 60 gigawatts of retirements that already are expected by 2030. However, coal still would make up between 3 percent and 8 percent of U.S. power by 2030 before new EPA rules are factored in. Just one EPA rule, its upcoming rule for pollution that crosses state lines, could see 23 gigawatts of coal-fired power retire by 2025.

However, readers should be aware that when comparing the costs of new subsidized wind and solar units to the operating and maintenance costs of existing coal, analysts do not factor in the cost of back-up energy or the batteries needed to cover the time when there is no wind or no sun to keep intermittent renewable technologies operating. That gives a huge advantage to wind and solar power in the calculation. If it were true that renewable sources are so much cheaper, electricity prices would not be climbing in renewables-heavy states such as California.

The issue that should worry Americans is grid reliability, which as mentioned above is not factored into the calculations. And, that is particularly alarming in the face of new demand stemming from the electrification of sectors like transportation, which in California is expected to double electricity demand. Countries in Europe, like the U.K. and Germany, had to power up their coal plants in case their wind turbines could not accommodate demand and ask their people to conserve more energy.

The U.K.’s grid operator asked a coal-fired power unit—one of five winter contingency coal units–to be ready to generate power during a recent cold snap. Electricity demand was expected to surge during a spell of cold weather in the U.K. just as falling wind speeds decreased power generation from the country’s turbines. National Grid had asked units in the coal reserve to get ready several times this winter but were able to stop short of requiring them to generate power because households were asked to reduce demand during several evenings to help balance supply at peak demand periods. The measure, however, demonstrates how vulnerable Britain remains to colder weather and fluctuations in wind output. The U.K. grid operator had to set aside as much as £395 million ($475 million) to pay coal units earmarked for closure to stay active this winter as reserve capacity.

Federal Subsidies are Not the Only Incentive for Renewable Plants

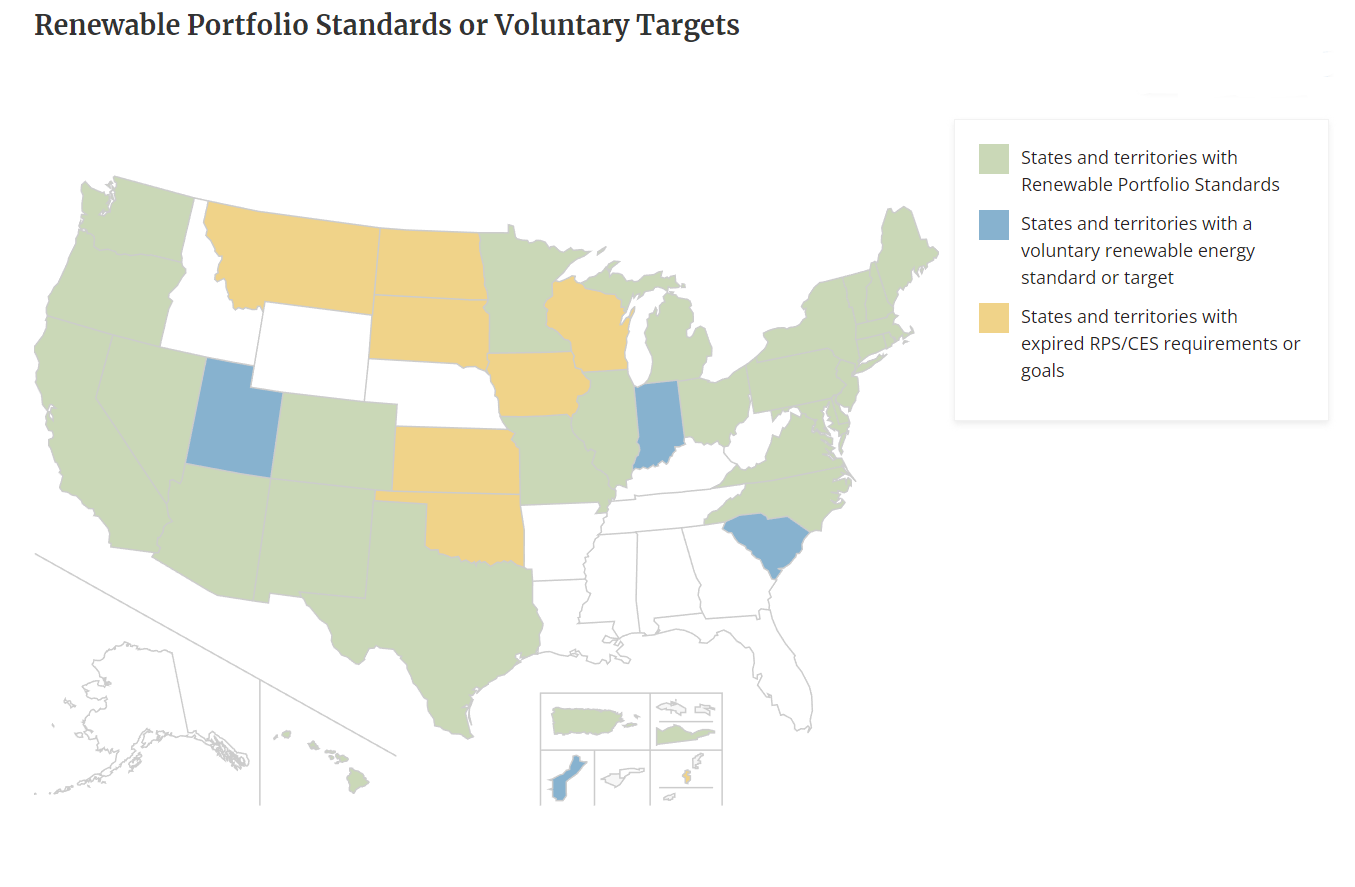

Much of the wind and solar market in the United States only exists because electric utilities are forced to buy their power. About half of the growth in U.S. non-hydroelectric renewable energy generation since the beginning of the 2000s can be attributed to state renewable energy mandates. Renewable Portfolio Standards (RPS) require utilities to purchase a certain amount of their power generation from renewable units. Consumers in states with RPS policies essentially pay a “green energy tax” that can raise their utility bills by sometimes twice what other states pay. For example, residential consumers in New York pay roughly 23 cents per kilowatt hour, while in Virginia, they pay 15 cents per kilowatt hour, and in Tennessee, residents pay 13 cents per kilowatt hour. In other words, governments that have instituted RPSs have taken away the power to choose from consumers and are driving higher electricity rates.

Conclusion

Coal, the powerhouse of the U.S. generation sector for many years, has had the Biden administration attack it through subsidies for favored renewable energy projects and by states that have mandates for their utilities to buy power from those units. Now Biden’s EPA is planning to add more regulations so that additional coal plants will be forced to retire because the cost to operate will be so high that they will not be able to compete against favored renewable plants. That is, EPA will make coal-fired electricity cost much more, and then argue coal plants are closing because they are uneconomic.

Biden wants to make sure that his pledges to the Paris Accord are met, but reliability problems can cause those pledges to fail. Reliability problems encountered in Europe during their energy transition are pointing out potential challenges when wind speeds decline and the sun stops shining. The U.K. grid operator, for example, keeps 5 coal units available for back-up and pays mightily for that capability.

While the Biden Administration wants you to believe that renewable energy is cost-effective, states with renewable mandates generally pay more for power than those without the mandates as noted above. Further, average U.S. residential electricity prices surged by 14.4 percent in October 2022 compared to a year earlier–double the 6.5 percent increase in the CPI. That’s proof that Biden’s policies are not working since Americans must pay more at the plug for electricity and taxpayers must pay for the subsidies to lower renewable costs. Americans are paying more by government edict, and their bills are rising rapidly.

*This article was adapted from content originally published by the Institute for Energy Research.